The delays that are marking the start of the 2025 second harvest corn in Brazil could further aggravate the already tight global grain stocks scenario, which are at their lowest in ten years. In its latest monthly supply and demand report, the USDA (United States Department of Agriculture) cut three million tons of global final stocks from 293.34 to 290.31 million.

The smaller stocks, also reflecting lower production, are a consequence of lower estimated production in, among other sources, Brazil and Argentina. Both countries lost one million tons in their crop estimates, which fell to 126 million and 50 million tons, respectively.

Global corn trade falls, but prices rise in major sources

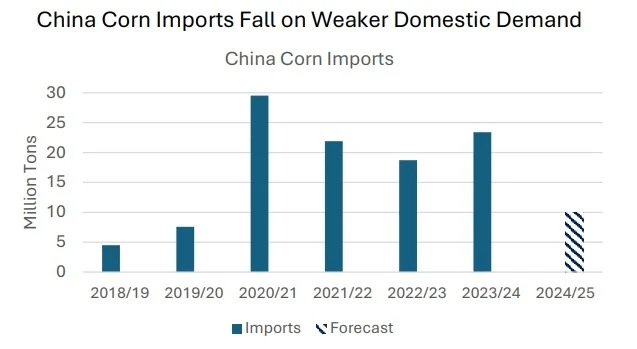

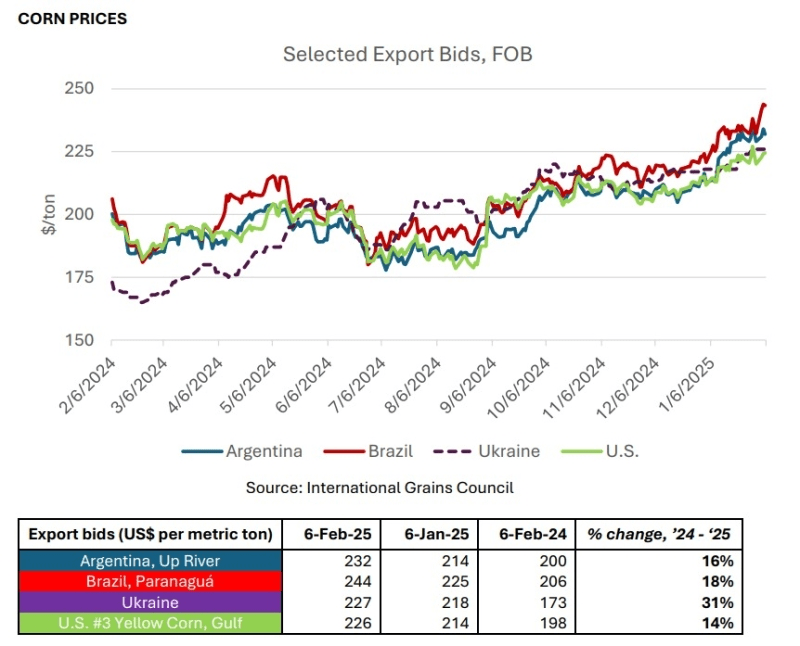

According to USDA experts, global trade flows have slowed in the past month, with lower exports from major suppliers such as Brazil and Ukraine, and imports from China also falling by around three million tonnes. Despite this, cereal price references have risen in all major supplier origins, a trend that has been observed since the USDA report in January.

In one month, corn prices in Brazil, based at the port of Paranaguá, rose from US$ 225.00 to US$ 244.00 per ton and had an increase of 18% compared to February last year; in Argentina, Up River, an increase of US$ 214.00 to US$ 232.00 from January to February and an increase of 16% in the annual comparison; in Ukraine, the price went from US$ 218.00 to US$ 227.00 in one month and increased 31% in one year; and in the USA, from US$ 214.00 to US$ 226.00 from January to February and registering an increase of 14% compared to February 2024.

Historic deficit and tight supply drive up corn prices in global market

And this imbalance between supply and demand, creating a historic deficit at this time, has acted as the central driver of prices in the global market. “The market remains cautious in the face of tight global stocks. In addition, the strong competitiveness of American corn in exports continues to be a prominent factor”, say market analysts at Agrinvest Commodities.

USDA weekly sales figures were released on Thursday (13). The data show that the United States has already committed 46.415 million tons of corn to exports. This volume is part of a total estimate of more than 62 million tons for the season. The number also represents a significantly higher volume than in the same period last year.

“The corn program will continue to grow. In addition to the competitive prices of American corn for export, the bad weather has already caused a significant reduction in the productive potential of corn in Argentina. The delay in the soybean harvest in Brazil is already reflected in delays in the planting of the second corn crop. And so it is possible that corn will enter Brazil later this season, extending the US export program,” adds Agrinvest.

Reports from rural producers indicate that rains have returned to parts of the Central-West and Matopiba regions, which continue to slow down the pace of planting of the second corn crop. Delays in planting, consequently, delays in harvesting. Thus, as analysts explain, the later harvest expected for this second crop “may result in a tightening of corn stocks at the end of the first half of the year and this may justify the increase in the May/25 contract on B3”.

Corn soars on B3 with an increase of up to 5.82% and the harvest faces logistical challenges

From the beginning of the year until the market closed this Thursday (13), corn futures traded on B3 registered a significant increase. The May contract led the gains, with an appreciation of 5.82%, going from R$ 72.53 to R$ 76.75 per bag. The July contract also advanced, rising 4.29%, from R$ 69.85 to R$ 72.85. The September contract increased by 3.70%, going from R$ 70.20 at the beginning of January to R$ 72.80.

And it’s not just the weather that is a concern for the development of the second corn crop. As Cristiano Palavro, director of Pátria Agronegócios, explained, the delays in the delivery of inputs for the second corn harvest. “We have been hearing more and more reports of problems in the delivery of corn, and this further complicates a process that is already behind schedule. We updated our corn figures with a reduction of four million tons in the total corn harvest,” he says.

Palavro details the scenario for the summer harvest, highlighting a reduction in the area in the two largest producers – Rio Grande do Sul and Minas Gerais – compared to last year, and with smaller area figures also for the second harvest. “We will not be able to put all that planning into practice until the end of 2024”.

As a result, the corn market remains very stable, both in terms of availability and contracts for the second harvest. This logistical issue is a concern, as delivery of inputs has been difficult in some regions,” concludes Cristiano Palavro.

Source: Carla Mendes | Notícias Agrícolas