Last week was marked by turbulence in the markets, with bearish economic data exerting a strong influence on commodity prices. The consumer price index (CPI) in the US, which rose to 3.5% per year in March, contradicted expectations and signaled that inflation remains resilient. Hedgepoint Global Markets these and other themes in the energy complex in this week's report.

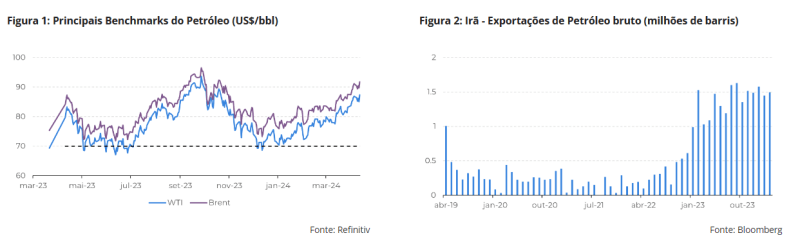

“In contrast to the decline in commodities generally, the energy market proved resilient last week, with WTI and Brent recording small losses of -1.44% and -0.79%, quoted at US$ 85.66, and US$ 90.45, respectively. This is because geopolitical tensions, especially the escalation of the conflict between Iran and Israel in the Middle East, continue to influence the oil market. The perception of risks to global supply drives demand for the commodity, raising its prices”, assesses Victor Arduin, Energy and Macroeconomics analyst at Hedgepoint.

According to the analyst, “at the moment, the conflict is expected to be limited to the developments of the last few days, but uncertainty will continue to hover over the market. Meanwhile, the main fundamental will continue to be the balance sheet in deficit due to the actions of OPEC+”.

Escalation in Middle East Brings Support for Oil

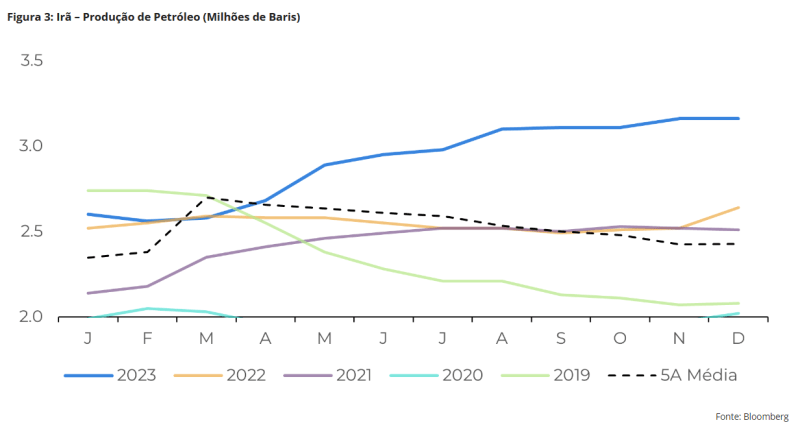

Last weekend, Iran launched a series of drone and missile attacks against Israel. This move was in retaliation for the Israeli attack on the Iranian consulate in Syria on April 1. This act marks Iran's first direct attack on Israel and, therefore, inaugurates a new phase in the conflict with the Middle East.

“Iran stands out as an important oil producer in the region, with current production exceeding 3 million barrels per day (bpd). As one of the world's largest exporters, any broader conflict affecting its energy infrastructure poses a risk to global supplies. In addition, the country frequently threatens to close the Suez Canal, an important maritime route for selling oil. When there is an increase in tension in the region, the risk of interruption in oil supplies increases. Whether through sanctions or direct attacks on infrastructure, which induces higher premiums in the market”, he explains.

“However, should the aforementioned events fail to materialize, we are likely to see a price correction. A broader escalation would result in major economic losses for Israel and Iran, in addition to causing increases in gasoline prices in the US,” he believes.

Greater demand in the US is a missing element in the market

Last week's macroeconomic outlook was marked by bearish data for commodities. Inflation in the United States remains high, reducing the chances of an interest rate cut in June this year.

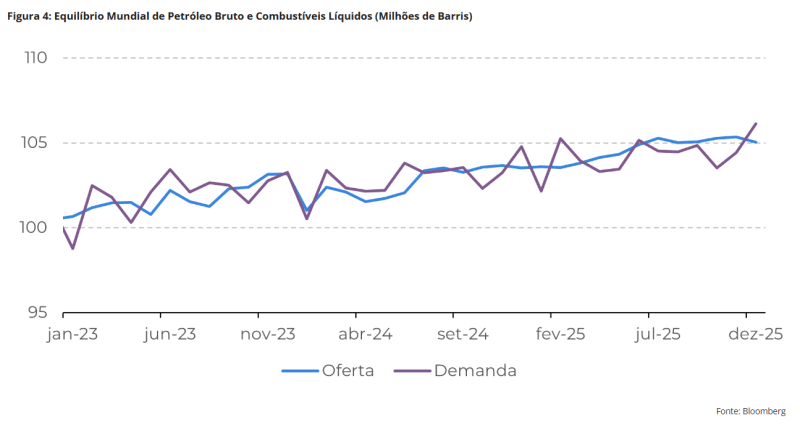

“As a result, the 2-year US Treasury yield closed at 4.88% (+3.17%), reaching a level not seen since November last year. Generally speaking, a stronger dollar is harmful for commodities, as it makes them more expensive for holders of other currencies. However, the actions of OPEC+, a group made up of the main oil exporting countries, proved to be effective in reducing supply in the market, resulting in a supply deficit that is expected to persist throughout the second quarter of this year”, he analyzes.

This strategy aims to balance the market and support barrel prices. The group implemented a voluntary production cut of 2.2 million bpd, with Saudi Arabia being the largest contributor, with 1 million bpd.

“This measure has contributed to the rise in prices, which registered an increase of more than 17% until April”, he highlights.

The main agencies that carry out studies on the sector predict deficits for 2024, with OPEC estimating a deficit of -1.64 million bpd, the IEA of -0.30 million bpd and the EIA of -0.26 million bpd .

The combination of persistent inflation, interest rates on hold and a strong dollar should generate negative pressure on commodity prices in the short term. This should result in a correction in oil prices, however limited, as the main sector agencies show a supply deficit for 2024.

Source: Hedgepoint | Notícias Agrícolas