On one side, Brazil is planting soybeans, on the other, the USA is harvesting it. Meanwhile, the dynamic global oilseed trade continues at full steam, mainly due to the strength of Chinese demand. The Asian nation is present in both countries, reaffirming its need, its commitment to food security and its time to replenish stocks and breeding stock.

RECORD NUMBERS IN BRAZIL

Brazilian ports, although at a slightly slower pace compared to the first half of 2020, continue to ship large volumes sold well in advance and thus, the total already shipped by the country reaches 83.4 million tons, compared to 60 million in the previous year. same period last year, according to figures from Secex (Secretariat of Foreign Trade). Thus, Brazil needs just over 100 thousand tons to reach its record of 83.5 million soybeans exported.

“We have already shipped 78% of the harvested crop, compared to 63% in the same period last year. The year is running faster and the grain is already gone and the bran is also ahead of schedule. The same happened with oil. From now on, we should see a drop in the pace of shipments across the entire sector, especially oil, which should be shipped very little because the domestic market has been paying much better than the external market and therefore, only previous businesses should continue to be shipped”, explains Vlamir Brandalizze , market consultant at Brandalizze Consulting.

Across the entire complex, shipments already total 97.6 million tons, also close to the 2018 record of 101.15 million tons.

{module 442}

HIGH PRIZES

The little soy still available in Brazil has been highly contested between exports and the domestic market, which has kept values at record levels – both in the interior and in ports – and premiums quite firm and valued. Also according to information from Brandalizze Consulting, the shortest positions have premiums – on the sellers' side – above US$ 2.30 per bushel above the values practiced on the Chicago Stock Exchange.

Therefore, as ARC Mercosul explains, “soy exports are going through a transition period to fill the shipping queues with corn. The scarcity of the oilseed in Brazilian territory has placed better offers in the industry, when compared to soybeans for export”. The amounts paid for available soybeans reached R$ 150.00 per bag in some locations, reflecting this scenario.

Likewise, advance sales of the 2020/21 harvest, which is now beginning to be sown, are also registering record pace and numbers, as it is almost 60% committed to commercialization. From Mato Grosso alone, China has already purchased 13.53 million tons. “This value is close to that observed in the 2013/14 harvest and above all other seasons”, explain the researchers from Imea (Mato-Grossense Institute of Agricultural Economics).

STRONG DEMAND IN THE USA

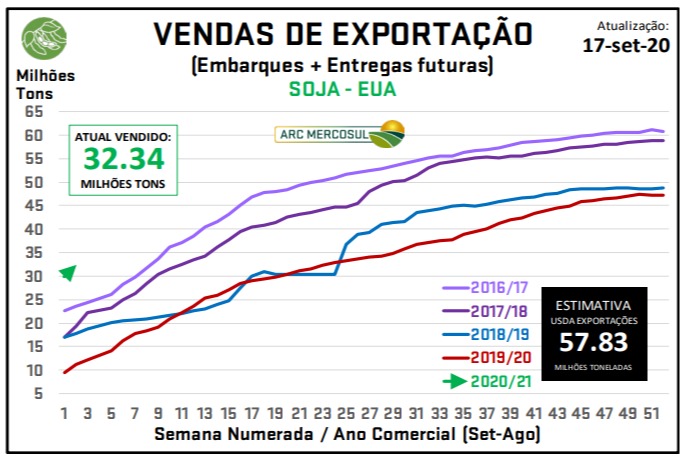

With these volumes and almost no availability of the oilseed, demand from China has been largely focused on the United States for months. And thus, the total already committed by the country reaches 32.43 million tons, well above the just over 11 million in the same period last year, according to figures from the USDA (United States Department of Agriculture).

Source: ARC Mercosul

And also according to USDA data, North American soybean shipments reach 3,567,160 million tons, up from just over 2.1 million last year, in the same period.

Source: Notícias Agrícolas

READ TOO:

{module 441}